By Toyin Falola

Sufie stands in the scorching sun in Sabon Gari; his hands protruding outside like a statue. He had no energy to talk and his legs were failing. But he has found himself in the midst of others, some on the floor and others running after each vehicle that passes–every man to his own problem. His last energy is reserved to keep him standing as long as he can and he stretches his little hand out as far as he could. He had just returned from the closest buka, where he would normally take customers’ leftover food, but wallahi, no customer this time so he has to face it. Sufie is one of the many beggars but business is no longer business as usual. He has learned a new English phrase, no cash, from everyone he begs for money. which is more like a bad omen. They all say the same thing as they walk slowly past him. From their demeanour and the looks on their faces, he sometimes thinks their troubles are far more than his. No one is dropping new ten naira notes into beggars’ plates, an obligation they usually do after receiving instructions from their spiritual guardians to give ten beggars 10 naira notes or do something similar. Standing emaciated, Sufie has not eaten in the past two days and there is no hope of food in sight. No Cash! Beggars suffer more!

Babagana, a sugarcane cart pusher, looked helplessly as his eight-year-old son asked for his daily feeding money to school. He looked up to the sky and wished this was not his reality. Some months back, he could confidently boast of his neatly stacked naira notes underneath his Ghana must go bag. Not too far in a distinct community, Mama Sade, a small-scale retailer, also counts her losses as her tomatoes perish without patronage. Her business no longer holds the prospect it had. The Emefiele saga has gotten to her. Mama no dey collect transfer! The pressure is getting wesser.

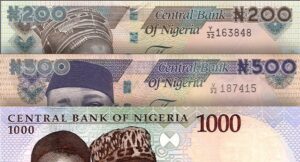

On October 26, 2022, the CBN Governor, Godwin Emefiele, announced that the Naira notes would be redesigned, with the Nigerian government claiming it would be a good attempt to withdraw the over N3.23 trillion Naira in circulation. The apex bank had claimed that one of the reasons for enforcing this policy is the fact that about 85 percent of naira notes are in circulation, outside the vault of banks in the country. Well, every society must find ways to strengthen its economy and a move towards a cashless policy is the right attempt to revitalise the economy; however, the challenge lies in the appropriateness of the enforcement of such policies and their effects on the people. The people’s welfare and interests must be first considered in all policymaking processes. All enforcement procedures must be carefully done in the best way so that they would not have minimum impact on the people.

Till today, Nigerians still wonder, “why the urgency?” If the purpose is to curb electoral malpractices, why then commence the process a few months before the election? Without considering the gimmicks and jokes about the “coloured” naira notes that have been taken too far, the general consensus on the street is that (1) the government and others would enact new policies to guarantee their success at the polls; (2) there is sabotage aimed at political parties and aspirants in the coming elections; and (3) there are massive embezzlement schemes by the outgoing government; among other these and that. While these are largely unfounded, given the situation of things, the odds, and the immediate effects of the policies, many have been unable to come up with arguments that would disprove the assumptions on the street. But the question I will always ask is, why the pressure?

I have not qualified the approach of the Central Bank in implementing its policies as unnecessary pressure, but society’s reaction and its consequences have shown that beyond doubt. The Nigerian transactional atmosphere rests primarily on the use and exchange of naira notes, as many of the minor commercial activities can barely function with a cashless policy in place. In line with the 2021 Global Findex Report, Nigeria is one of the seven countries that are major contributors to the number of unbanked citizens in the world as it ranks third among others. Forty percent of Nigerians are unbanked, a total of about 59 million adults out of the total population. Most of these individuals are women and about 73 percent of all of them do not even have the required documents to open a bank account. Far into the villages, where there are barely any banks within a radius of a two-hour drive, you will not be surprised if the policies are more like a pronouncement of hardship. In 2022, Nigeria was ranked the fifth country in the world with less banking penetration. This means that there is a Chioma somewhere in the South East who does not have a bank account, does not have access to a bank, and is being cut off from the order of things right now. While the policy is allowed to take effect slowly, the apex bank could double up on ensuring accessibility to banking and financial services.

The implementation of a cashless policy in any society has to be a slow but steady process to make society adjust to it, and not an aggressive and pressurised withdrawal of cash from circulation. No matter how cashless policies are implemented, it is impossible to go completely cashless. One does not need to be an economist to know this; so, CBN, why the pressure? After taking cash from the hands of individuals, what alternatives were provided? Mobile banking? Reliance on Point of Sales Machine (POS)? We just dey play. Many of the villages and even parts of the urban areas still struggle with internet access. As at December 2022, only a little above 108 million Nigerians had access to the internet and also make use of it–77 percent of Nigerians in rural areas and 36 percent in urban areas did not have access to or use the internet. This means there is a large margin of those who would be able to use some of the alternatives available to the people. Still, the data projection is quite low because, by 2027, only 60 percent are expected to have access to the internet.

Coupled with the massive emigration of technology experts in the banking sector, the financial technology aspect of the Nigerian banking sector has proven rather unreliable. You could wait for frustrating minutes or even hours before a transfer of funds goes through, money may be reversed, or you sometimes would not be able to use the banks’ USSD codes at all. Similar issues occur with the use of debit cards at POS points. POS operators, owing to the difficulties in getting cash, now charge high rates for cash withdrawals. These rates are now within the range of 15 to 30 percent, and you will shout 21 Hallelujahs if you are lucky to find any in operation. How would the common men and women survive? Is it reasonable to charge a POS fee of N1,500 on every N5,000? Does it make sense to transfer N200 to buy tomatoes from Mama Sade when bank charges are outrageous and she cannot even go inside the bank to withdraw her money at the counter or even through her ATM card? Should beggars now use POS to collect money from their “customers”? How do you expect Sufie, Babagana and his family, and Mama Sade to survive the aggressive enforcement of the cashless policy if the preliminary issues are not first addressed? It is important that the CBN knows that there is no need for pressure; short and long-term plans in ensuring enforcement would only be good for everyone.

While this Naira imbroglio is going on, fuel is still in short supply and pump prices remain on the high side, causing more hardship to the misery the citizens are already facing. Considering these challenges, the increasing cost of commodities, insecurity, and all other forms of torture that the people are going through, you will realise that pressure ti wa! In response, the citizens have taken to the street in a more violent way. The system does not favour them, things are expensive; they find a way to work and earn something, only to be denied access to their hard-earned money. It is both funny and annoying, and many of these reactions are understandable even if they are not acceptable. Burning of banks that are themselves deprived of naira will not help matters. Causing violence is a further investment in hardship, and endangering the lives of fellow Nigerians in the banking sector is a case of the oppressed oppressing the oppressed. Well, there is a limit to the guidelines and directives one can give a hungry man, so I will just implore you to think before you leap.

Also, it seems that the government does not have an idea of what goes on and what approach to take. The nation is confused about who to follow in the emerging power tussle. In its judgement, the Supreme Court has ordered the reversal of policies. Many governors have shown disagreement, others have given their own directives, and some institutions have expressed their varying takes. The National Council has its own position, while the CBN governor goes another way. The President found another spot, and the First Lady has asserted, disclaimed, and reasserted in a little space of time. It seems the nation is on autopilot towards an abyss. These are crucial times. Nigerians are deciding their leadership and many incidents are still ongoing.

In the face of all of these, I urge Nigerians to take it easy on themselves. They should resist the temptations to engage in violence but try as much as possible to explore alternatives until the winds settle. There is a need for a community approach to solving some of these problems, especially in rural areas. It is high time those in charge of the grassroots took care of their people. Most importantly, the people must not let these issues discourage them from participating in deciding the leadership of the nation at all levels before, during, and after the elections. It should serve as a wake-up call to the fact that 2023 is not a year for compromise. Whatever troubles the country is currently facing, let us see it as a sacrifice and the price we have to pay to rescue our land from the hands of the devourers. We have been fighting these wars and winning, no matter how small our victories appear to be. Truly, pressure ti wa, but we are Nigerians–no matter the pressure, we meuve!

**This piece was written before the February 25 elections and during the crisis of petrol shortage and naira confiscation.